Blah blah briefing of the

textile and apparel sector

How the sector can meet its climate goals

Nov 2021

Nov 2021

Briefingpurpose

This briefing document aims to make the

solutions for climate change real.

Often action related to climate change tends

to get diffused. That is especially true of the

textile an apparel sector, whose value chain

employs 100s of millions of people in almost

every country in the globe.

This briefing note provides a framework to

analyzes the entire production and brings

granularity on the key levers to move.

This document has been produced by the

Sustainable Industries practice at cKinetics.

About the title

The title of this document was inspired by Greta

Thunberg’s address at the Youth4Climate in Sep

2021. Her message was that that there has been

lots of talk (blah blah blah) and little action.

This briefing document is based on the analysis

of commitments (talk) of several hundred

players in the textile and apparel sector. And

tracks the impact, assuming they get converted

to action

Almost1/10

th

ofman

madeemissions

The textile and apparel sector touches every aspect of our

daily lives. Their production and sale, generates 2.5 billion

tons of greenhouse gas emissions annually.

The sector’s emissions are increasing in absolute terms; as

well as a percentage of global emissions. It represents 7.25%

of total man-made emissions presently and is expected to

reach 9.5% by 2030.

The increasing use of polyester is perhaps the single biggest

factor. This briefing will touch upon other drivers as well.

Summary

2465

Million

tons of

greenhouse

gases

80

Million

Tons of fiber

converted to

products

7.25

Percent

of mankind’s

annual GHG

emissions

641

34

3.1

Percent

annualized

consumer

demand growth

395

Million

People

employed by

the sector

Webof

impactof

textileand

apparel

sector

Million

tons influenced

by 165

companies

165companiesinfluence

24%oftheemissions

cKinetics conducted a study to analyze and trace the

emissions of the sector. 165 companies across the globe and

across the production value-chain (from fiber all the way to

product) generate and influence 608 million tons (or about

24% of the sector emissions).

56companiesplanning

emissionsreduction

Many of the companies have set goals and shared details on

them. All this has happened within the last 3 years. It is likely

that this trajectory will continue, especially after factoring in

various national climate pledges.

Tracking action over the next few years will be critical.

Percent

of large companies

that have emission

reduction goals

Howtovisualizeis1billion

tons?

All people on earth weigh 0.5 billion tons

Global plastic consumption is 1 billion tons

Global annual consumption of meat is 0.3 billion tons

Global annual fiber that we convert into products is 0.1

billion tons

These are the emissions generated in the making

of textile and apparel products that we consume

Whatkindofproducts

generateemissions?

Our daily lives are intertwined with textile and apparel

products. From the moment we wake to the time we go to

bed, we use them all the time.

Just consider some examples: the bed we have slept on

(sheets, pillows, mattresses), the towels we have used, the

clothes we adorn ourselves, the seats of the vehicle we use

to commute, napkins we use at our meals, etc.

We also see textiles in packaging (container bags),

agriculture (mats, crop-covers, nets), building construction,

hospitals (masks, gowns, gauzes), etc.

Emissions are generated in the manufacturing process that

covers:

1. Making (or growing) the fiber

2. Converting the fiber into yarn

3. Converting the yarn into fabric

4. Shaping the fabric into the final product

2.465

billiontonsofCO2e

peryear

395

Millionpeopleemployed

acrosstheglobe

Economicimpactishighest

inemergingcountries

The sector also tends to be a large component of the GDP in

several emerging markets.

In many cases, it tends to be the dominant manufacturing

sector- providing higher income opportunities than those

otherwise available.

Textile and Clothing (% of manufacturing sector)

The sector also creates lots of employment and

generates significant economic impact

Employmentacrossa

varietyofvocations

The textile and apparel sector has a long value chain that

touches a variety of different vocations. In many countries it

tends to be one of the larger employers.

And in sub-segments like cut-sew the employment is

dominated by women.

Estimated global employment (in millions)

Farmers and fiber preparation 300

Industrial workers (chemicals,

mills, man made fiber, etc)

20

Cut-sew-make (textile and

apparel)

75

Store workers (whose work

cannot be attributed to the

textile and apparel sector alone)

100

Cambodia 87%

Bangladesh 51%

Sri Lanka 32%

Pakistan 29%

Honduras 22%

Vietnam 16%

Guatemala 11%

Source:UNFashioncharter,ILO,Fairtrade,NationalRetailFederation Source:WorldBank.UnitedNationsIndustrialDevelopment

Organization,InternationalYearbookofIndustrialStatistics.

Billions

1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030

0

5

10

15

20

25

30

35

40 20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

Global Emissions Textile sector Emissions Textile sector contribution

Global GHG emissions level increased by 26 % in

the last decade whereas the GHG emissions level

due to textile sector increase by 42% in the last

decade.

In the upcoming ‘decisive’ decade of the climate

change fight, the global emissions are expected to

increase by 5% while the emissions due to textile

sector are expected to increase by 30% during the

same time period.

Textile and Apparel sector contributed to 5.23% of

total global GHG emissions in 2010 which increased

to 7.25% in 2020. The share of textile sector

emissions is expected to reach 9.5% in global GHG

emissions by 2030 (this factors the known emission

reduction plans).

Emissions as a percentage of global emissions is

increasing; expected to grow further from 7.2% to 9.5%

9.5%

ofglobalemissionswillbe

fromthissector

Projected

Source:GlobalEmissionstill2020fromEPA,TextileandApparelsectordatafromcKineticscomMITdatabase,cKinetics

projections

Global GHG Emissions and Textile Sector Emissions

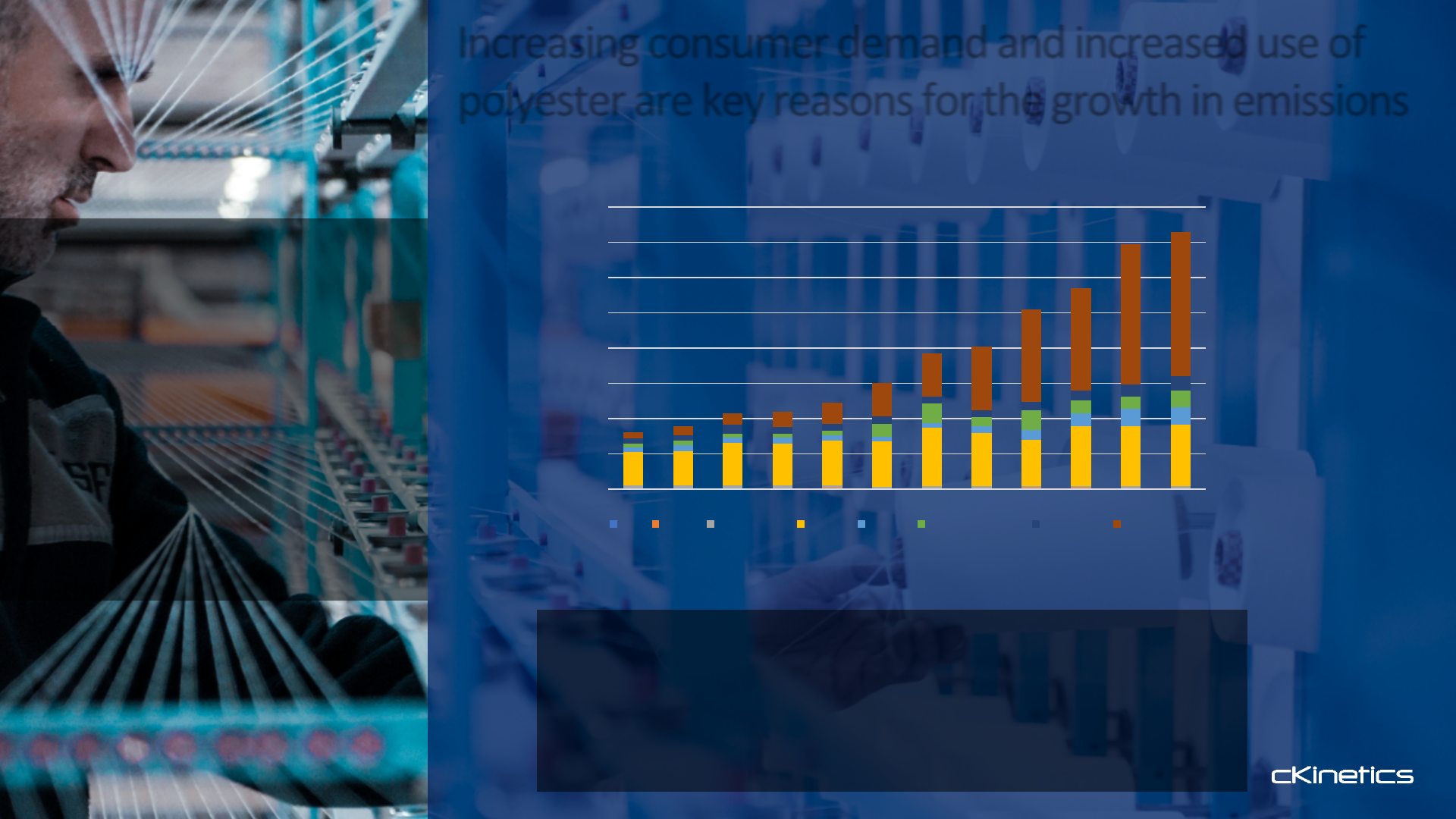

Our demand for textile and apparel products

continues unabated.

To feed that demand, global fiber production

increased 40% in the last decade whereas the

production of polyester increased by 60% at the

same time. Polyester has emerged as the most

preferred fiber because of its low price, versatility,

physical propertied and recyclability.

Global fiber production is expected to increase by

28% (from 2020 levels) by the end of this decade

while the polyester production in expected to

increase by 41% (from 2020 levels) by 2030.

The production of polyester caused 710 million

tons of GHG emissions which was 24% of the total

emissions due to textile sector in 2020.

Increasing consumer demand and increased use of

polyester are key reasons for the growth in emissions

3.1%

Annualizedhistorical

growthrateofdemand

1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030

0

20

40

60

80

100

120

140

160

Silk Down Wool Sheep Cotton MMCF Other synthetics Polyamide Polyester

Global Production of Fibers (Million Tons)

Source:TextileExchange.(2020).PreferredFiberandMaterialMarketReport2020

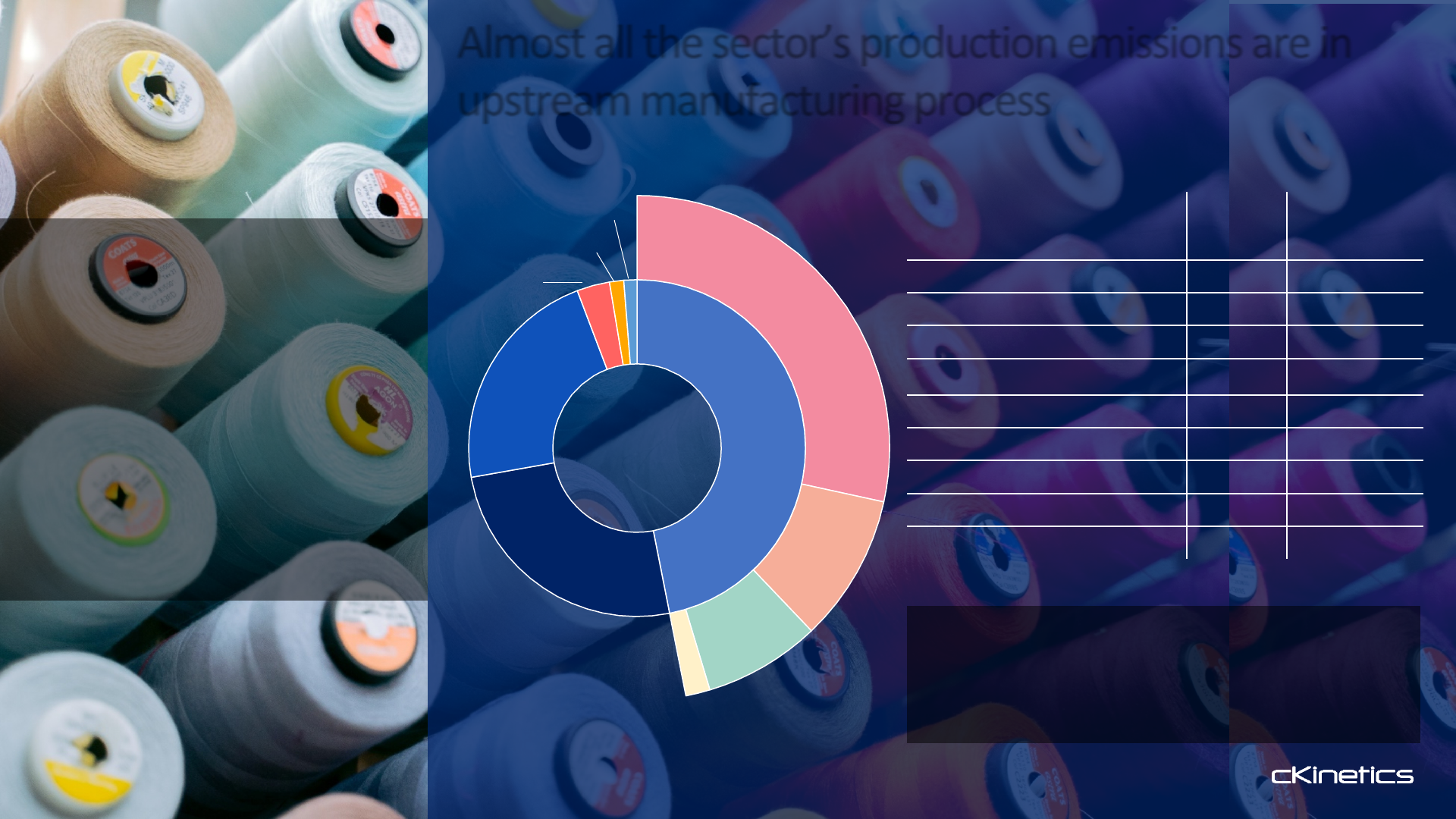

Almost all the sector’s production emissions are in

upstream manufacturing process

92%

oftheemissionscomefrom

upstreamprocesses

Polyester

Cotton

Otherfibers

MMCF

Fiber

Fabric

Production

YarnConversion

CutSew

Emissions

(Million

tons CO2e)

Percentage

Polyester Production 710

28.4%

Cotton Production 236

9. 5%

MMCF Production 39

1. 6%

Other Fiber Production 187

7.5%

Yarn Conversion 510

22.0%

Fabric Production 633

25.3%

Cut Sew 79

3.2%

Apparel brands logistics and selling 34

1.4%

Other textiles logistics and selling 32

1.3%

2.5 Billion

TonsofCO

2

Eq

cKinetics estimates for the different

manufacturing process are based

on a study conducted in 2021

The team estimated the quantity of

material as they go through the

different processes: constructing a

mass-flow.

Subsequently, the most recent

emission factors were applied for

each process. These factors were

determined by studying the

emissions of ‘pure-play’ firms in

that space.

Emissions for different processes

CutSewMake

Apparelbrands

Othertextiles

Source:cKineticsresearch,cKineticscomMITdatabase

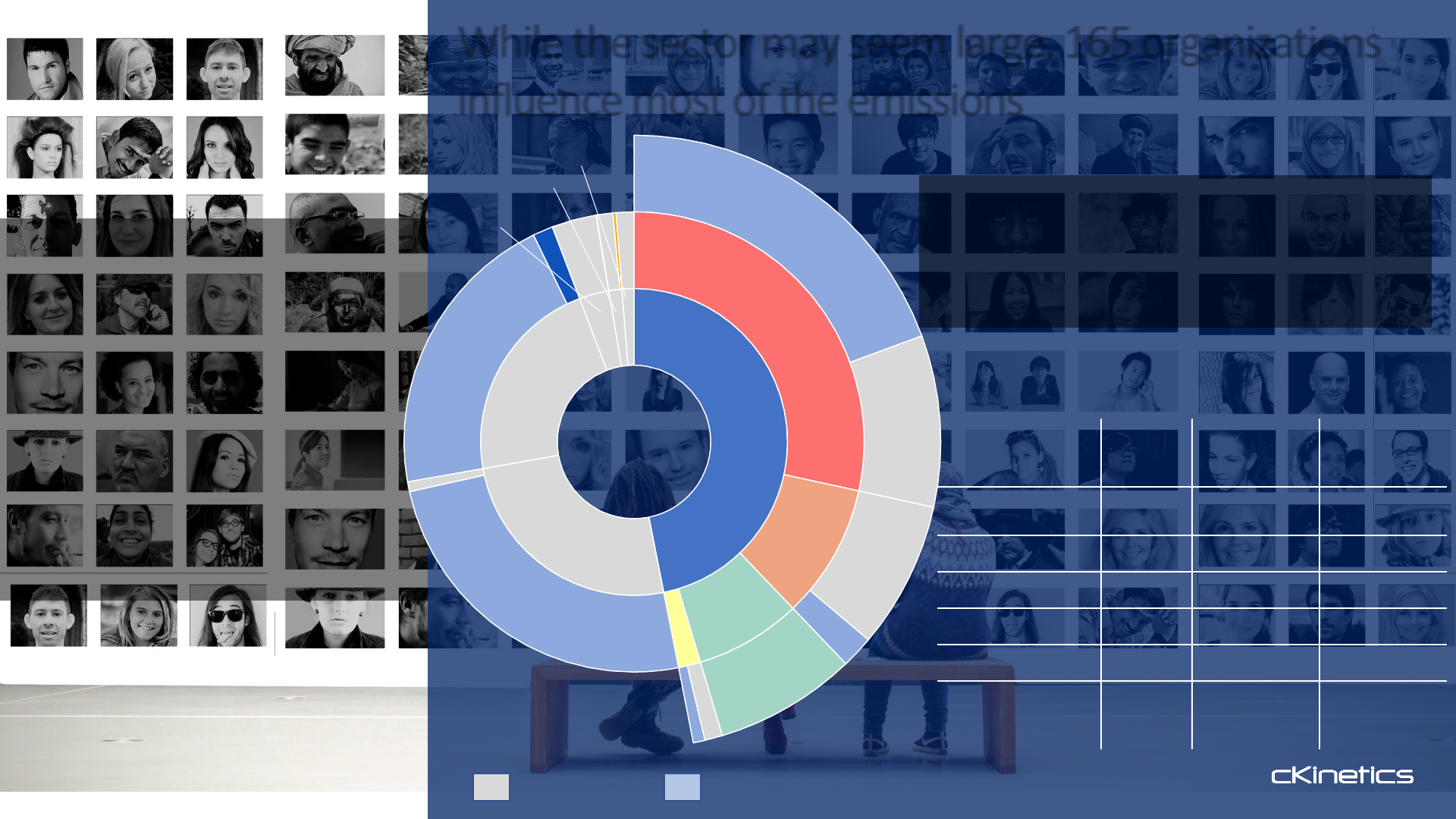

While the sector may seem large, 165 organizations

influence most of the emissions

2.5 Billion

TonsofCO

2

Eq

165

Companiescontrol24%of

theemissions

Traced

Untraced

Polyester

Cotton

Other fibers

Untraced

Untraced

Untraced

Fiber

Untraced Traced emissions

cKinetics analyzed the sources of

emissions of each of the production

processes, by identifying key firms

and researching their emissions.

Key firms are those that are a

significant in the process – from a

production volume standpoint and/

or from their influence on the

emissions in that stage.

The 165 companies identified span

the globe and are listed at the end

of this briefing.

CutSewMake

Apparelbrands

Othertextiles

Process Key firms Emissions

(Million tons of

CO

2

eq )

% process

emissions

traced

Polyester Production 19 484.5 68.2 %

MMCF Production 7 23.6 68.5 %

Cotton Production 12 42.6 18.1 %

Yarn Conversion 32 35.5 6.5 %

Fabric Production 66 23.8 3.8 %

Textile/ Apparel

Brand and Retailers –

logistics and selling

29 7.1 11.9 %

Emissions that were traced

Source:cKineticsresearch,cKineticscomMITdatabase

One third of the key players across the value chain have

made commitments to reduce emissions

56

of165organizationshave

emissionreductionplans

Number of key

firms with targets

Polyester Production 2

MMCF Production 6

Cotton Production 6

Yarn Conversion 2

Fabric Production 12

Brands and Retailers 28

Brands All major brands and retailers

Yarn Toray Industries, Aditya Birla yarn

Cotton Olam and Glencore agriculture

MMCF

Birla Cellulose, Zalando SE,

Eastman Chemical, Kelheim Fibers,

Lenzing and Sateri Holdings

Polyester

Reliance Industries and SiNopec

Yizheng Chemical Fiber

SBTI, 29

Others,

27

No

Target

Target

Absolute,

23

Both, 15

Iintensity,

13

Other, 5

No Target

Target

Over the last few years, many

organizations have committed to

emission reduction goals. The textile and

apparel sector is no exception.

Science Based Target Initiative (SBTi) is

the most commonly adopted framework

for goal setting.

In addition many organizations have

communicated emission reduction goals

in their annual plans and sustainability

reports (classified as others in the chart).

These are part of their communication/

commitments to investors or to meet

their respective national mandates.

Framework for goal setting Types of goals set

The key organizations have set a mix of

goals to reduce emissions. Absolute goals

are those where the organization

commits to reduce a fixed amount of

emissions. Intensity based goals are

where the emission reductions are linked

to either production or revenue. Some

organizations have both absolute and

emission goals.

56 have emission targets by 2030

30 out of the 56 have net-zero

goals by 2050

Even if all current emission reduction commitments are

met, overall sector emissions are expected to grow

40%

emissionreductions

neededby2030isunlikely

basedonpresenttrajectory

Emissions if the key orgs met their reduction goals

641

Thekeyplayersrepresent

astartingpoint

It is likely that more of the key players (beyond the 56) will

set emission reduction goals in the coming years. The harder

task will be in implementing those plans.

However, even if the existing plans known are met, the

emissions of the key players will fall from 641 million tons of

CO2eq to 580 over this decade: a drop of 9.6%. This factors

the growth of production anticipated in the same time

frame.

Willthisbecomeahard-to-

abatesector?

40% greenhouse reduction by 2030 (from 2020 levels) is

what is needed at a global level to meet climate goals.

The trajectory of the textile and apparel sector is such that

emissions could grow from 2.5 billion tons CO2e (current) to

3.1 billion tons CO2e by 2030. Rather than contribute to a

decrease in emissions, this sector is likely to increase.

The reduction initiated by the key players will have to be

followed by changes throughout the sector. This decade is

crucial.

Emissions in 2019

(Million T CO2 eq)

Emissions in 2030

(Million T CO2 eq)

580

But, there are also some tailwinds that could accelerate

decarbonization of the sector

6

Levers,thatleadersinthe

sectorscantakeadvantage

ofinthenearterm

Nationalmandates

emerging

Several jurisdiction are framing pathways for

emissions reductions into law:

• 17 countries have incorporated net-zero

goals into law

• 27 countries have made pledges and 5

have policy development underway

These can drive / accelerate manufacturer

investment plans to adopt clean technologies.

Emergingconsumer

awareness

Consumers have been slow to engage.

However, increasingly surveys are showing

that Gen Z (1997-2012) especially in North

America and Europe are growing up believing

Climate Change to be an existential threat.

It remains to be seen how that translates into

purchase decisions as they come into their

earning years.

Greeningelectricity

grid-30%impact

Many countries across the globe are aiming

for a zero emission grid by the mid-century.

As electricity gets decarbonized so will yarn

conversion and parts of fabric production

(about 30% of the sector’s emissions).

If electricity becomes green and inexpensive,

it could also pave the way for large scale heat

-pump adoption in fabric production.

Reducingimpactof

fibers

Preferred fibers are gaining traction: from

recycled polyester to better cotton. Recycled

materials are becoming more available.

Additionally, key polyester and MMCF

manufacturers are making plans to go carbon

neutral.

Fiber choices will be crucial in determining

the pathway for the sector.

Alternatefuelsin

selectregions

Half the energy consumed in fabric

production is thermal energy. Presently that

is a significant source of emissions as fossil

fuels are used.

In select regions there is a move towards

cleaner bio-based fuels: renewable natural

gas, biomass, etc.

Carbonmarketsand

climatefinance

The last few years have seen:

• Investors adopting ESG principles,

requiring their investments to address

climate issues

• Emergence of ‘green’ lines of capital

seeking to invest in green projects.

• Carbon markets are re-emerging, that

form potential revenue streams for

alternate fuels/ green tech

Methodology

Methodology and Data sets used

Mass-flowtraced

acrossthesector

The research supporting this briefing is based on

developing (and tracing) the mass flow from the

time a fiber is produced to the time a product is

manufactured.

There were two components that were

reconciled:

1. Top-down view on the ‘expected mass’ that

ought to be there in the different production

processes. The starting point here is the fiber

produced annually and projecting it across the

various processes.

2. A bottom-up view to trace the ‘actual mass’

based on tabulating the production and capacity

of the manufacturing facilities / companies.

This provided a granular view on details like

location, production efficiency and latest

emission factor.

Using #1 and #2, a mass-balance was constructed

for the different processes and for the overall

textile and apparel ecosystem. This helped

determine areas where there was sufficient

information to make informed projections (high

confidence); and areas where the estimations in

the projections have higher variance (lower

confidence). Overall, the analysis presented in

this briefing note, takes the data points where

confidence on accuracy is high.

Datasourcesand

extrapolations

The following core data-sets have been used:

1. Company public disclosures – annual reports,

sustainability reports, press releases

2. Fiber data- from Textile Exchange, UN

Comtrade Database, Regional Export Promotion

Councils

3. Commitments presented on SBTi and reduction

plans from CDP

4. Emission factors from the cKinetics comMIT

database

Determining current emissions of companies

Where companies provided the information on

emissions, that was used directly.

In cases, where the textile/ apparel sector

operations were part of a larger conglomerate or

where information was not disclosed, the

emissions were estimated by using either the

production or revenue; and applying the relevant

emission factor for the process.

Estimating future emissions (by 2030 and 2050)

Where companies have stated goals for 2030

and/or 2050 emissions, those were used directly.

Where companies had goals for 2025 or beyond,

those goals were extrapolated.

In both case, the production was assumed to

increase at the industry growth rate.

Companyprofiles

developed

In addition to looking at the goals, the emission

reduction plans for each of the companies were

enumerated.

This helped establish confidence on goals at a

company level. That was done by comparing the

reduction plans with:

1. the best-available-techniques in the process/

industry

2. the peer group within that industry to

understand further scope that may exist in a

company or in a sector

Presently work is under-way to compile this

analysis and make it available to clients. It will be

provided as part of cKinetics’ comMIT database.

Organizations

Key organizations analyzed and profiled

Textile/ Apparel Retailers and

Brands

Adidas

ASICSCorporation

AuchanHolding

BurberryLimited

Decathlon

FASTRETAILING

GapInc.

Guess,Inc.

H&MHennes&MauritzAB

IKEA

Inditex

Kering

LeviStrauss&

LojasRennerS.A.

lululemon

LVMH

Marks&Spencer

NIKE,Inc.

PUMASE

PVHCorp.

TargetCorporation

TJMaxx(TJXcompanies)

VFCorporation

Walmart

Cotton sourcing

ADMCotton

Bunge

Cargill

CofcoIntl

Ecomtrading

GlencoreAgriculture

LouisDreyfus

NamoiCotton

Olam

Omnicotton

MMCF production

BirlaCellulose

CelaneseCorporation

DaicelCorporation

EastmanChemicalCompany

FormosaChemicals&Fiber

IndoramaVentures

KelheimFibresGmbH

LenzingAG

SateriHoldingsLimited

ShandongYamei

SilverHawk

TangshanSanyou

XinjiangZhongtaiTextileLtd

YibinGrace

Polyester Production

Alpek

AsiaPacificfibers

BillionIndustrial

BombayDyeing

FarEasternNewCentury

FujianJinlun

HengliGroup

Huvis

JiangsuSanfangxiangGroup

LealeaGroup

MitsuiChemicals

NanYa

NingboDafa

Reliance

RongshengPetroChemical

SiNopecYizhengChemical

Fibre

TongkunGroup

TorayIndustries

WilliamBarnet&Son(Limited

Liabilitycompany)

XinFengMingGroup

ZhejiangGuXianDaoIndustrial

Fiber

ZhejiangHengyiGroup

Material Conversion

AdityaBirlaYarn

AdvanceDenimLimited

AksaAkrilikKimyaSanayiiA.S.

AlokIndustriesLimited

AmberTextileMills

AnhuiAnliMaterial

TechNology

ArtisticGroup

ArvindLtd

AsahiKaseiCorporation

BestPacificTextile

BeyteksTekstil

BillionRiseKnitting

BlackPeony

BondexInt'L

BrimadonaIndustrialCoLtd

BrosTextile

CalikDenimTekstilSanayiVe

Ticaret

ChiaoHwaIndustry

Color&TouchCo

CrescentTextileMills

DeLicacyIndustrialCo

DollarIndustries

EagleNice(International)

Holdings

EclatTextileCo

ErdemTekstil

EsquelEnterprisesLtd

EverestTextile

FareastCorp

Feroze1888MillsLimited

FormosaTaffetaCo

FountainSet(Holdings)

Limited

FountainSetLimited

FulltechFiberGlassCorp.

GadoonTextiles

GarwareTechnicalFibres

Limited

GratefulTextileCo

HWearTextiles

HimatsingkaSeideLimited.

HongdaHigh-TechHolding,

Huafufashion

HuafuGroup

HyosungCorporation

IbrahimFibresLimited

IlshinSpinning

IndahJayaTextile

IndoCountIndustriesLimited

Interloop

IsraqSpinningMills

JiangsuGuotaiInternational

GroupHualianIndustry

JiangsuLianfaImp&Exp

JiangsuLianfaTextile

JiangsuLugangCulture

JindalWorldwideLimited

Jungwoovina

KamHingInternational

Holdings

KamaHoldingsLimited

KewalKiranClothingLimited

KingdomHoldingsLimited

KOLONMATERIALS

KPRMills

LanFaTextile

Li-ChengEnterprise

LuThaiTextile

M.L.Dyeing

MahmoodTextileMills

MarzottoSpA(Italy)

MenderesTekstilSanayive

TicaretANonimSirketi

NewWide(Hk)Int'LCo

NiceDyeingFactory

NienHsingTextile

NishatMills

NomanTextilesMillsLtd

OrtaAnadoluTicaretVe

SanayiIsletmesiT.A.S.

P.TKahatex

PacificTextilesHoldings

Limited

PageIndustriesLimited

ParamountTextile

PFNonwovensa.s.

PTPolychemIndonesiaTbk

PTTificoFiberIndonesia

PtWinTextile

RaymondLimited

RecronMalaysiaSdnBhd

ReginaMiracleInternational

Riopele

Rupa&

SOneTextile

SaebanTextileCo

SankoPazarlamaIthalat

IhracatANonimSirketi

SankoTextile

SapphireTextileMills

SewangTextileCo

ShanghaiTiqiaoTextile

SnsFashion

SoenmezPamukluSanayii

ANonimSirketi

SportkingIndia

SquareTextiles

SritexIndonesia

TaihanTextile

TainanSpinning

TaiwanPaiho

TatFungTextileCo

TexhongTextileGroup

Tex-RayIndustrial

TexwincaHoldingsLimited

ThaiPolyesterCompany

Limited

ThaiWacoalPublic

TopSportsTextileLimited

TridentGroup

UniversalIncorporation

VakkoTekstilveHazirGiyim

SanayiIsletmeleriA.S.

VardhamanTextiles

VishalFabrics

WeiqiaoTextileCompany

Limited

Welspun

Winnitex

XingyeLeatherTechNology

XinlongHolding(Group)

YakjinIntertex

YoungTextile

ZheJiangJasanHoldingGroup

ZhejiangSaintyearTextile

ZhejiangTaihuaNewMaterial

ZhejiangXinaoTextilesInc

ZigShengInd

Contact

To learn more about the study or the analysis, contact:

Pawan Mehra, Managing Director

Rekha Rawat, Director, Sustainable Industries

Projects+SBT@cKinetics.com

www.cKinetics.com

Cupertino, California, USA

New Delhi, India